20,000+ Girls Served with JPMorgan Chase Financial Health Program

One of the highlights of my professional career has been working with Girls Inc. since the 1990s, including serving on the national-level Board of Directors. JPMorgan Chase is proud to support Girls Inc. through its Women on the Move program, which represents the firm’s latest commitment to promote gender diversity and equal opportunity. We are empowering girls and teaching them vital skills for life.

Joyce Chang, Chair of Global Research

Women on the Move equips girls with the skills to gain financial confidence

Girls need to know how to make the numbers work for them, and JPMorgan Chase is putting the power of numbers in girls’ hands with economic literacy training and mentoring so that they can succeed in school and beyond. The JPMorgan Chase Women on the Move program is a Girls Inc. National Sponsor of Economic Literacy, which represents the firm’s latest commitment in promoting gender diversity and equal opportunity by bringing financial health programs to 20,000 girls across the country.

In March 2019, JPMorgan Chase became the Girls Inc. lead national sponsor for Economic Literacy. The partnership launch was celebrated with the ringing of the closing bell on the floor of the New York Stock Exchange.

Economic Literacy for All

Women on the Move started as an internal initiative to empower JPMorgan Chase’s female employees to grow their careers. The firm has expanded its focus to help female business clients launch and grow their businesses and to help female consumers improve their financial knowledge and financial health. Teaching girls fundamental economic and financial concepts, such as saving and investing, during formative stages in their lives is key to developing financially healthy women for the future. The Women on the Move partnership with Girls Inc. does just that. Economic literacy is being provided to girls and the adults in their lives nationwide, through programming, mentoring, and workshops that are supported by JPMorgan Chase employees taking place in five key markets—New York City, the San Francisco Bay Area, Chicago, Atlanta, and Boston.

Workshops & Events for Skill-building and Inspiration

JPMorgan Chase began hosting the Girls Inc. Money Talks Family Financial Literacy Workshops last fall, engaging JPMorgan Chase employees in networking activities, field trips, mentoring and workshops. In 2019, Girls Inc. hosted two Money Talks workshops: one at Girls Inc. of the Island City in October 2019 and one in November 2019 with Girls Inc. of New York City. These workshops actively engaged girls from the ages of 12 to 14 and the adults in their lives (parents, caregivers, and other family members) through group activities that included creating their own savings jars and sharing their financial goals. Most importantly, the girls had a chance to debunk financial myths so that conversations about money became empowering and unintimidating.

At the October Money Talks event, five JPMorgan Chase volunteers—Jessica Wessely, Bev Correa, Diana Azizyan, Brendaliz Valenzuela, and Suzanne Harris—participated along with Jessica’s own mother, plus 16 Girls Inc. girl-parent pairs in a series of activities and exercises.

At the November Money Talks event, seven JPMorgan Chase volunteers—Stefanie Altschuler, Sam Azzarello, Naomi Oleary, Liz Iaconis, Marlie Vredenburgh, Erica Sukay and Nancy Jiang—participated, plus 18 Girls Inc. girl-parent pairs in a series of exercises, utilizing a JPMC budget worksheet.

Money Talk Event in New York City (November 2019).

Impactful Programming: Starting Young and Involving Families

Through the Girls Inc. Economic Literacy program, girls learn about the economy and money, including how to manage, invest, and save money and how to help others through philanthropy. As girls explore how the economy affects everyone locally and globally, they develop skills critical to being financially savvy and to becoming economically independent adults. Our partnership gives girls of every age access to appropriate economic literacy programming.

She’s on the Money! is for girls ages 6 to 8 and uses games, role playing, art projects, and field trips to build girls’ skills for identifying and counting money and to increase their understanding of basic concepts and topics, such as using banks and saving for the future.

Dollars, Sense, and Me is for girls ages 9 to 11 and further enhances girls’ understanding of economic and financial systems by introducing them to the concepts of exchanging goods and services, investing in the stock market, entrepreneurship, budgeting, writing checks, and labor and management.

For middle school girls ages 12 to 14, Equal Earners, Savvy Spenders deepens girls’ knowledge about and appreciation for economic and financial topics covered by previous components. This is where girls are introduced to topics such as loan options, risk versus return on investments, consumer research, credit card use, labor laws, economic equity for women and girls, work-life balance, and global economics. Futures and Options, for girls aged 15 to 18, prepares girls to enter the world of work by helping them examine topics such as attitudes and values about money, career strategies, economic justice and workers’ rights, paycheck deductions, responsible use of credit, avoiding predatory lenders, renting versus buying, and investing.

The Money Talks workshop at Girls Inc. of the Island City brought girls and the adults in their lives together around the topic of finances.

Activities to encourage conversation between parents and guardians and their girls at our Money Talks workshop in October.

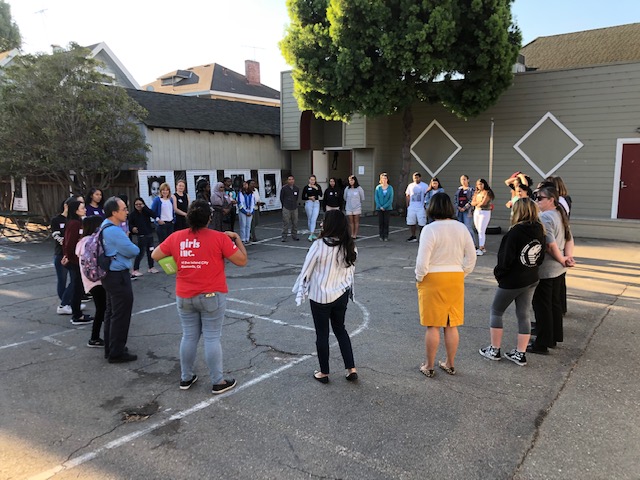

On September 4, 2019, girls in California from affiliates including Girls Inc. of West Contra Costa, Girls Inc. of Alameda County and Girls Inc. of the Island City participated in a JPMorgan Chase Sweatworking event at the new Chase Center in San Francisco. The theme was Girls Equity & Equality + Financial Health, and Golden State Warriors point guard Stephen Curry joined as a surprise guest. ABC 7 News featured interviews with Girls Inc. girls here.

Strength and independence were emphasized at the September 2019 Sweatworking event where Golden State Warriors point guard Stephen Curry was a surprise guest.

Stephen Curry leading girls in the Sweatworking workout at the new Chase Center in San Francisco.

Role Modeling & Mentoring Make the Difference

JPMorgan Chase Volunteer Engagement is also the arm of our sponsorship that allows JPMorgan Chase staff and employees to share their time and talents with the girls of Girls Inc. and vice versa. Girls Inc. of New York City alumna Samarra Scantlebury was offered the opportunity to take center stage and speak to hundreds of attendees of the JPMorgan Chase Women on the Move Leadership Conference on October 7, 2019 at Radio City Music Hall.

Samarra speaking to the attendees of the Women on the Move Leadership Conference at Radio City Music Hall.

Samarra also participated in an interview with Andrea Lisher (Managing Director of North America, Global Funds, JPMorgan Asset Management) on Cheddar, a live streaming financial network that broadcasts from the floor of the New York Stock Exchange, for their ChedHer International Day of the Girl programming on October 11. The interview was shared with the media outlet’s 4.5 million social media followers on Twitter and Facebook.

Andrea Lisher and Samarra with the Cheddar hosts on the floor of the NYSE.

Perhaps most meaningfully, JPMorgan Chase staff serve as Role Models and Mentors to Girls Inc. girls across the country, helping to shape the way girls look at the world and find their empowered place within it. We also worked together to create meaningful mentoring opportunities for girls to connect with JPMorgan Chase employees around the exploration of future career possibilities in Boston (December 2019), Atlanta (January 2020), and Chicago (January 2020).

An economically independent adult is not born—she is educated!

Together, JPMorgan Chase and Girls Inc. are showing that access to strong and comprehensive financial literacy education leads to financial health and independence for girls. With this partnership, thousands of girls are finding solid footing when it comes to money management and economic literacy. It’s a truly strong, smart, and bold endeavor—and one that is the heart of the mission for both Girls Inc. and JPMorgan Chase.

Joyce Chang

Chair of Global Research

JPMorgan Corporate & Investment Bank