Girls Grow In Economic Literacy with Support from JPMorgan Chase

Economic literacy is a skill. As with reading and writing, a working knowledge of basic economic concepts is essential for any young adult’s future success. We believe it is critical that girls have the support and skills to enhance their financial competence and help them exercise control over their financial future. Given long-standing gender disparity in pay and income, it is also critical that girls gain a sense of economic justice so that they can better understand and assert their rights and advocate for the economic wellbeing of all girls and women.

Facilitating a Girl’s Financial Journey

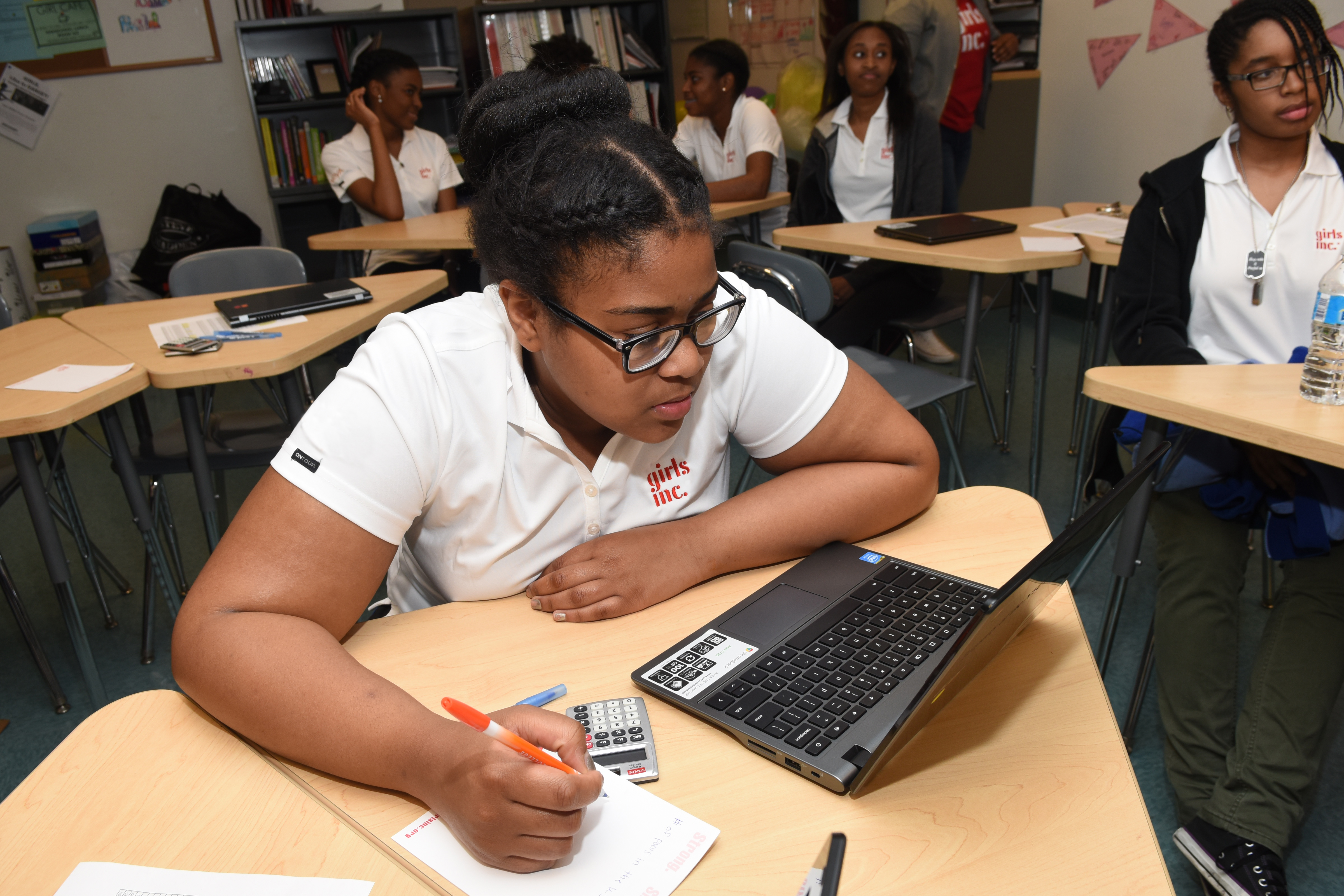

Girls Inc. and JPMorgan Chase Women on the Move came together in July 2020 to host a series of three workshops centered on crucial financial concepts that reached over 200 Girls Inc. girls. The series, “Your Financial Journey” was fully facilitated by JPMorgan Chase employee volunteers. While girls learned about setting financial goals, savings, budgeting, and credit, they engaged with adult role models who shared their expertise and shed light on the wide variety of careers available in the financial services industry. Each session led to thoughtful conversation and learning opportunities for the girls. They discussed their financial goals that ranged from saving for college to creating a rainy day fund, practiced developing budgets and savings plans, and received a crash course in credit.

A Cornerstone of Girls Inc. Programming

The “Your Financial Journey” series is one of the offerings Girls Inc. makes available through its Economic Literacy programming for girls ages 6-18, which is taught in a culturally-sensitive environment with a focus on gender-specific issues. Beyond basic economic concepts, Girls Inc. teaches girls how to recognize and overcome financial obstacles specific to women and enhances girls’ financial confidence and competence, empowering girls to recognize early on that they can exercise control over their financial future.

These programs reach over 25,000 girls across the United States and Canada. As the national sponsor of this program, JPMorgan Chase creates additional opportunities for Girls Inc. girls to enhance their financial skills, connect with role models, and practice networking. JPMorgan Chase also created an infographic to help women gain knowledge and tips on approaching their personal finances that Girls Inc. girls, facilitators, and supporters can access here.

Girls Inc. Economic Literacy is making the difference for girls, according to a two-year study released by the American Institutes for Research. Girls Inc. girls are more prepared for and interested in careers in finance, economics and technology, have higher standardized math test scores, and are more prepared for life after high school.